- #How to categorize personal expenses in quickbooks generator

- #How to categorize personal expenses in quickbooks trial

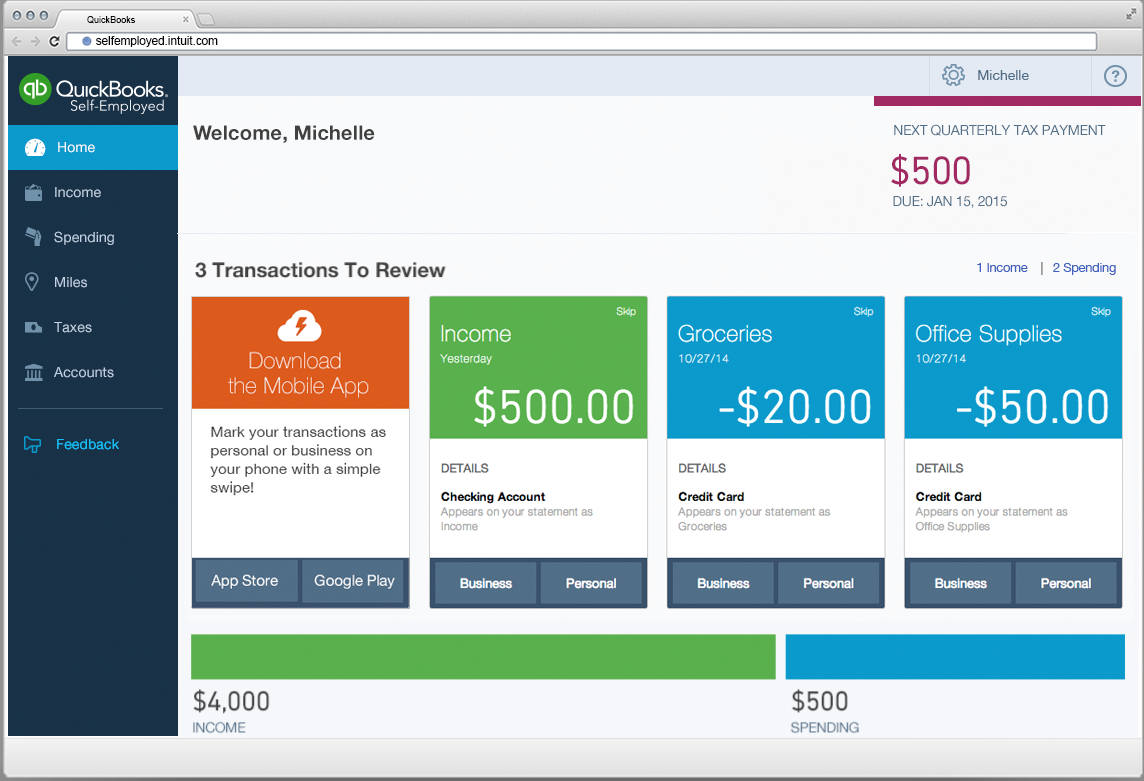

QuickBooks Self-Employed is from Intuit, the maker of TurboTax, QuickBooks, and Mint.

#How to categorize personal expenses in quickbooks trial

Any unused portion of a free trial period will be forfeited after purchasing a subscription. You may manage your subscriptions and auto-renewal may be turned off in Account Settings after purchase. Your subscription will automatically renew monthly unless canceled at least 24-hours before the end of the current period for the same amount that was originally purchased. Subscriptions will be charged to your credit card in your iTunes Account at confirmation of purchase. Price, availability and features may vary by location. Purchased TurboTax Self-Employed? Activate QuickBooks Self-Employed today at no extra cost.Īlready have QuickBooks Self-Employed on the web? The mobile app is FREE with your subscription, and data syncs automatically across devices. *Users will receive one state and one federal tax return filing. Instantly export your financial data to TurboTax Self-Employed by upgrading to the Tax bundle*.Directly export Schedule C income and expenses.Easily organize income and expenses for instant tax filing.We do the math so you can avoid year-end surprises.

#How to categorize personal expenses in quickbooks generator

Are you self-employed, a freelancer or an independent contractor? Organize your finances with QuickBooks Self-Employed and let us help you find your tax deductions! Put more money in your pocket with this convenient mile tracker, expense tracker, invoice generator and tax deductions estimator.

0 kommentar(er)

0 kommentar(er)